SoftBank Group Acquires UK Semiconductor Startup Graphcore

Japan’s SoftBank Group, led by Chairman Son Jeong-ui, has acquired British semiconductor startup Graphcore as part of its investment in the artificial intelligence (AI) field.

According to the Financial Times on the 11th (local time), Nigel Toon, co-founder and CEO of Graphcore, announced on that day that “we will join the SoftBank Group to build next-generation AI computing.”

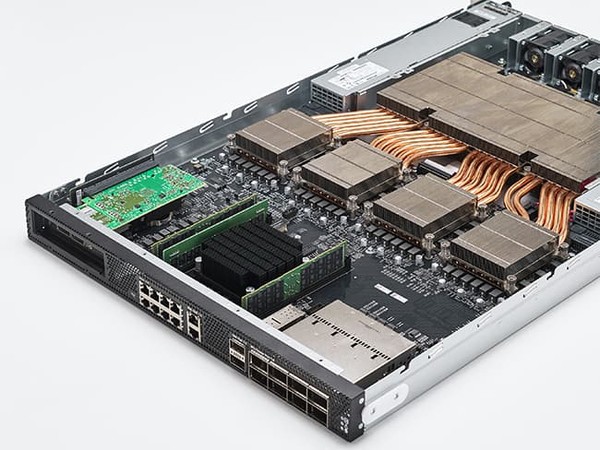

Graphcore, founded in 2016 by British semiconductor industry veterans, has been seen as a competitor to Nvidia, which dominates the high-performance AI chip market, when it comes to its “intelligence processing units” designed specifically for AI applications.

Doosan Group reorganizes its business structure into three sectors: energy, machines, and semiconductors

Doosan Group is reorganizing its management structure into three major business divisions: ‘Clean Energy,’ ‘Smart Machines,’ and ‘Semiconductors and Advanced Materials.’

Doosan announced on the 11th that it has decided to reorganize its affiliates into divisions that fit the nature of its three major businesses. Doosan Energy, Doosan Bobcat, and Doosan Robotics held board meetings on the same day and approved a plan to reorganize the governance structure, including the division and merger of subsidiaries and a comprehensive stock exchange.

The core of the semiconductor and advanced materials sector is Doosan Tesna, which has the largest domestic market share in the system semiconductor wafer testing sector. The group’s advanced materials business, which produces electronic materials for semiconductors, mobile phones, and electric vehicle batteries, will be located in this sector.

Cadence, Samsung Foundry Collaborate on 2nm Process

Cadence Design Systems announced that it is collaborating with Samsung Electronics Foundry to develop technologies to accelerate AI and 3D-IC semiconductor design, including the cutting-edge 2nm process gate-all-around (GAA) node.

Cadence collaborated with Samsung Foundry to conduct Cadence’s Cerebus Intelligent Chip Explorer and AI Design Technology Co-Optimization (DTCO). As a result, the leakage power of the 2nm process (SF2) GAA platform was reduced by 10%. The two companies are actively participating in the development of test chips, including using Cadence.AI tools in SF2 designs.

Cadence also accelerated advanced design development by obtaining implementation flow certification for Samsung’s SF2 BSPDN. Cadence RTL to GDS flow is enhanced to support BSPDN implementation requirements such as routing, nano TSV insertion, placement and optimization, timing and IR analysis, and DRC.

Yongin City, notice of approval of industrial complex plan for Semes Co., Ltd., the largest semiconductor equipment company in Korea

Yongin Special City announced on the 12th that it had approved the ‘Giheung Future City Advanced Industrial Complex Plan’ to be developed by Semes Co., Ltd., the largest semiconductor equipment company in Korea, on a 94,399㎡ site in Gomae-dong, Giheung-gu.

The Giheung Future City Advanced Industrial Complex, which Semes Co., Ltd. is developing to build a technology development center, is expected to invest approximately KRW 255.6 billion by 2026. The technology development center is expected to be built as a 20-story building, and the exact construction cost has not been determined. The industrial complex also includes Samsung Electronics, a substation that supplies electricity to areas with power shortages such as Giheung, Hwaseong, and Dongtan, as well as support facilities and a small park site.

The city received an industrial complex allocation from Gyeonggi Province in September 2021 for the purpose of attracting semiconductor equipment companies. In November 2022, Semes Co., Ltd. applied for approval of the industrial complex plan to the city, and the project began in earnest. The project was finally approved after a resident briefing session, strategic environmental impact assessment, and three rounds of Gyeonggi Province industrial complex plan reviews.

Eight Japanese companies, including Sony and Toshiba, to invest 43 trillion won in semiconductors by 2029

The Nihon Keizai Shimbun (Nikkei) reported on the 9th that eight major Japanese semiconductor companies, including Sony Group and Mitsubishi Electric, will invest 5 trillion yen (approximately 43 trillion won) in semiconductor facilities in Japan by 2029.

Nikkei reported that the following was compiled from the nine-year facility investment plans from 2021 to 2029 that eight companies – Sony, Mitsubishi Electric, Rohm, Toshiba, Kioxia Holdings, Renesas Electronics, Rapidus, and Fuji Electric – have already confirmed.

The Sony Group will invest approximately 1.6 trillion yen from 2021 to 2026 to increase production of semiconductor image sensors. Following the expansion of production in Nagasaki Prefecture last year, the company has also set a plan to establish a new plant in Kumamoto Prefecture. Sony’s competitive image sensors are expanding their applications, including as a result of increasing demand for smartphone cameras and autonomous vehicles.

Sepratech, Daejeon Yuseong-gu 2nd factory completed… Semiconductor small business leap forward

Sepratech (CEO: Chung-Kyun Yeom), a membrane specialist, announced on the 10th that it has completed construction of its second plant in the Daedeok Research Complex in Yuseong-gu, Daejeon and has begun full-scale operations. The second plant has a land area of 4,000㎡ and a factory area of 2,640㎡, and invested approximately 8.5 billion won.

Sepratech plans to produce more than 300 membrane contactors (10-inch standard) per month at its second plant, which are used in various industries, including degassing membranes for industrial semiconductor ultra-pure water (MDG), hazardous alcohol (IPA), biogas, nitrogen, and carbon separation.

The second plant is characterized by having an integrated production facility capable of producing everything from membrane yarn to modules.

Intel Invests 18 Billion Won in DS Techno

According to Wonju City on the 11th, Intel invested 18 billion won (8%) in DS Techno Co., Ltd. located in Munmak, Wonju, and became the 4th largest shareholder. It is known that this is the first time Intel has invested in a small and medium-sized Korean company.

Intel’s decision to invest this time is to strengthen its supply chain in the foundry sector, and to secure stable business expansion through competitive semiconductor material component procurement and cost reduction, according to market analysis.

DS Techno is the only semiconductor manufacturing company in Korea that can manufacture silicon carbide (SiC), silicon (Si), and quartz.

Hyundai Mobis, which is converting its US electric vehicle plant, receives 45 billion from the Biden administration

Hyundai Mobis will receive a subsidy worth $32.6 million (approximately KRW 45 billion) from the U.S. government.

According to the automobile industry on the 12th, the U.S. Joe Biden administration announced on the 11th (local time) a plan to provide $1.7 billion (about 2.3536 trillion won) in subsidies to convert 11 aging automobile and parts factories in 8 states, including Michigan, into electric vehicle manufacturing plants.

The subsidy recipients include Hyundai Mobis’s US subsidiary, GM (General Motors), Harley-Davidson, Volvo, Fiat Chrysler, and ZF, among eight others. Hyundai Mobis plans to convert the Stellantis plant in Toledo, Ohio, into a hybrid assembly plant. It also plans to build a battery assembly plant in the Toledo area. The US government has decided to provide a total of $32.6 million to Hyundai Mobis.

POSCO Group Battery Materials Growth Target Lowered

POSCO Holdings has reduced its secondary battery materials production target. It appears that it is adjusting its speed in response to the electric vehicle chasm (temporary sluggish demand).

POSCO Holdings (005490) announced at the ‘3rd POSCO Group Secondary Battery Materials Business Value Day’ held at the POSCO Center in Daechi-dong, Seoul on the 12th that it would generate approximately 11 trillion won in sales from the secondary battery materials business by 2026 and disclosed this in the electronic disclosure system.

This is a smaller figure than the target set by POSCO Holdings last year. Last year, POSCO announced that it would achieve sales of 16 trillion won by 2025, but the target was reduced by 5 trillion won a year later.

Hyundai and Kia’s Electric Vehicle ‘Charging Alliance’ Expands… Japan’s Toyota Joins

Toyota, the world’s largest automaker, announced on the 10th (local time) that it will invest in Ionna along with seven other automakers to build an electric vehicle charging network across North America.

Iona is a joint venture established by seven major global automakers, including Hyundai, Kia, and BMW, to build an electric vehicle charging network in North America.

Last July, the companies announced that they were forming a “charging alliance” with BMW, General Motors (GM), Honda, Mercedes-Benz, and Stellantis.

Volkswagen considers closing Audi plant in Brussels amid sluggish EV sales

The Volkswagen Group announced on the 10th (local time) that it is considering restructuring or even closing the Brussels plant due to weak demand for the fully electric vehicle ‘Audi Q8 e-tron’ line being produced there, according to CNBC and the Wall Street Journal (WSJ).

The Brussels plant has been producing the Audi Q8 e-tron electric car since 2019 and employs 3,000 people.

If the plant closure does happen, it would be the first for Volkswagen in nearly 40 years, with the most recent being the closure of a plant in Westmoreland County, Pennsylvania, in 1988.

China BYD signs electric car factory agreement with Turkey three days after EU ‘tariff bomb’

Chinese electric car company BYD is building a new production plant in Turkey, state-run TRT Haber broadcaster and AFP reported on the 8th (local time).

BYD Chairman Wang Chan-fu signed an agreement to build a new plant worth 1 billion dollars (approximately 1.38 trillion won) with Industry and Technology Minister Mehmet Fatih Kazr in Istanbul on this day, in the presence of Turkish President Recep Tayyip Erdogan.

BYD plans to build a new factory in Turkey with the capacity to produce 150,000 electric and hybrid vehicles per year, and also open a research and development (R&D) center. It also plans to directly hire 5,000 people in Turkey. BYD’s new factory is expected to start operation around the end of 2026.

EV Advanced Materials “Prologium, Full-scale Launch of All-Solid-State Battery Business”

Eve Advanced Materials announced on the 12th that Prologium, in which the company invested, is building a gigafactory worth 5.2 billion euros in Dunkirk, France.

It will be the first large-scale solid-state battery manufacturing facility in Europe and will have an annual production capacity of 48 GWh.

Eve Advanced Materials has invested 10.1 billion won in Prologium. The company forecasts that France’s secondary battery cathode material market will continue to grow along with the increasing demand for electric vehicles and energy storage systems.

CATL to Promote Establishment of 2 Trillion Won Offshore Fund… “Expanding Supply Chain”

The Financial Times (FT) reported on the 11th that China’s CATL, the world’s largest electric vehicle (EV) battery manufacturer, is pushing to create an offshore fund worth 2 trillion won to build a global supply chain.

CATL plans to contribute about 15% of the fund together with global investors, and it is said that it will mainly target companies that supply to CATL in Europe.

The reason CATL is seeking to raise funds overseas rather than in China is reportedly due to China’s strict capital control system. In China, companies must obtain approval from the Chinese government to make overseas direct investments above a certain level, which is usually difficult and can take months.

Tesla’s self-driving robotaxi unveiling postponed from August to October

Bloomberg reported on the 11th (local time) that Tesla decided to postpone the unveiling of its robotaxi, originally scheduled for August, to October, citing the need for more time to produce prototype vehicles. An anonymous source said, “This week, the design team was instructed to rework certain elements of the vehicle.”

Tesla’s robotaxi attracted market attention in April when CEO Elon Musk said it would be unveiled on August 8, when Tesla’s stock price had fallen more than 30% since the beginning of the year.

The autonomous robotaxi is a product currently under development by CEO Musk, who envisions using Tesla’s own autonomous driving technology to transport passengers without a driver and for a fee.

Baidu RoboTaxi Gains Popularity in China… Existing Taxi Businesses Hit

According to the Hong Kong South China Morning Post (SCMP) on the 10th (local time), as Baidu’s autonomous driving service ‘Apollo Go’ operating in Wuhan, Hubei Province rapidly gained customers, local taxi drivers requested the city’s transportation authorities to restrict the use of the service.

Baidu, China’s largest portal site operator, is operating about 500 self-driving cars in Wuhan. It launched Apollo Go, a Baidu-affiliated autonomous driving service platform, in August 2022.

According to local media, Wuhan Jianshe Transportation, a taxi company in Wuhan, sent a letter to the authorities last month, saying, “Four out of 159 taxis have stopped operating since April due to decreased income,” and criticized that “robotaxis are taking away ordinary people’s jobs.”

SOS Lab, Next-Generation Autonomous Driving LiDAR “Commercialization Test within the Year”

SOS Lab announced on the 10th that the development of the next-generation autonomous vehicle 3D fixed lidar ‘ML-A’, which is being developed together with a global auto parts company, is progressing smoothly. HL Mando began investing in SOS Lab in 2018 and is currently the third largest shareholder (5.4%, as of the end of December last year).

SOS Lab expects to produce initial samples for commercialization as early as the second half of this year and conduct vehicle installation and performance tests within the year.

The ‘ML-A’ product is a high-spec fixed 3D lidar optimized for vehicle installation. The recognizable horizontal angle is 60 degrees, and can cover a total field of view of 120 degrees based on a left-right pair.

German Kartken raises 31.2 billion won with autonomous driving SW for delivery

Tech.EU reported on the 4th (local time) that German robotics startup Kartken has received a total of $22.5 million (approximately KRW 31.2 billion) in investment to advance its autonomous driving software (SW).

Cartken recently raised $10 million, bringing its total funding to $22.5 million. Existing mobile robot solutions for last-mile delivery and industrial environments often struggle with indoor-outdoor transitions, limiting their use to specific environments.

Kartken’s autonomous driving system eliminates these limitations, allowing it to easily navigate a variety of environments, including industrial complexes, production facilities, university and office complexes, and neighborhoods.

Xiaopeng Unveils Pure Vision System Similar to Tesla FSD… Lidar Excluded

Citing sources, CNV Post exclusively reported on the 8th (local time) that Chinese electric vehicle manufacturer XPENG will unveil a pure vision system that excludes LiDAR in its electric vehicle (codenamed F57) scheduled for release in the fourth quarter. The XPENG F57 will implement a smart driving solution using only cameras, like Tesla’s FSD (Full Self-Driving). Currently, most Chinese electric vehicle manufacturers are installing LiDAR.

In September 2021, Xpeng launched the P5 EV sedan equipped with two lidars, and has since equipped the P7i, a facelift of the P7, as well as the G6, G9, and X9 with lidars.

LG Display to generate half of its sales from OLED, riding on iPhone and iPad

LG Display is accelerating its business structure transformation to focus on organic light-emitting diodes (OLEDs). This year, the company aims to fill more than half of its total sales with OLEDs. To achieve this, the company is reducing the production of low-profitability liquid crystal displays (LCDs) and strengthening its product line with small and medium-sized OLEDs.

According to LG Display’s 2024 Sustainability Report, the share of OLED in the company’s total sales increased from 32% in 2021 to 40% in 2022, and to 48% in 2023. As performance expands in the small and medium-sized OLED sector, which has been considered a weakness, the share is expected to increase to over 50% this year.

“10th Generation Apple Watch Display Size Increases to 49mm”

The display size of the 10th-generation Apple Watch, which Apple will release this fall, will increase to 49mm. However, it seems unlikely that the major health-related functions that were expected will be included.

Bloomberg News reported on the 7th (local time) through the PowerOn newsletter that the Apple Watch 10, which will be released this year, will be equipped with a larger screen and a new chip.

According to reports, the Apple Watch 10 will not have a significantly different design from its predecessor, but it is expected to be thinner. It is also expected that the Apple Watch Ultra 3 this year will not have a new design.