WSJ: “Semiconductor tariffs will only be exempted to the extent that they are produced in the US.”

The Wall Street Journal (WSJ) reports that the Donald Trump administration is considering exempting semiconductor companies from tariffs only for the amount they produce in their U.S. factories. This is seen as a strategy to reorganize the global semiconductor supply chain around the U.S. by increasing U.S. production by semiconductor companies to match imports.

The WSJ reported on the 26th (local time), “The Trump administration wants semiconductor companies to match their chip production and imports in the U.S. on a ‘1:1’ basis,” and “Companies that fail to achieve a 1:1 ratio of U.S. production and imports will have to pay tariffs on their products.”

Automotive semiconductor rivals Infineon and Rohm form SiC alliance.

Infineon announced on the 26th that it signed a Memorandum of Understanding (MOU) with Rohm to collaborate on the development of SiC power semiconductor packages for use in onboard chargers, solar power generation, energy storage systems (ESS), and artificial intelligence (AI) data centers. The two companies will strengthen their collaboration as a second source for SiC power device packages.

Second sourcing refers to securing the ability to procure identical or compatible components from two or more suppliers in the semiconductor and electronics industries.

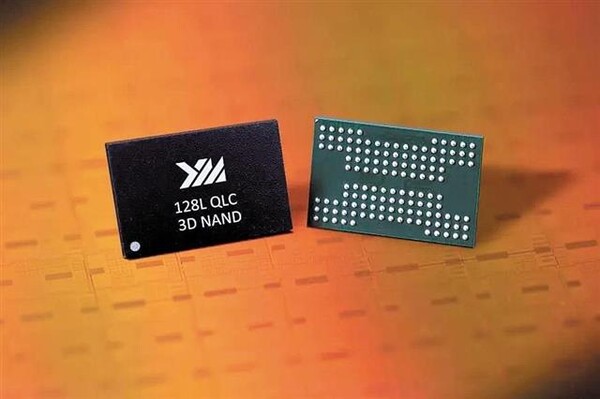

China’s YMTC prepares to enter the HBM market, accelerating semiconductor independence.

Yangtze Memory Technology (YMTC), China’s largest memory semiconductor company, is planning to enter the high-bandwidth memory (HBM) market, Reuters reported on the 25th.

Citing multiple industry sources, Reuters reported that YMTC plans to expand its business into DRAM manufacturing, including HBM.

Reuters explained that the move by state-owned YMTC “shows the growing urgency to strengthen advanced semiconductor manufacturing capabilities since the United States expanded export controls on HBM to China in December last year.”

Nuvoton Unveils AI MCU with 100x Increased Computing Power

On the 24th, Nuvoton held a press conference at a hotel in Seoul and introduced the next-generation AI MCU ‘NuMicro M55M1’ and the AI model development and distribution toolkit ‘NuML’.

MCUs are ultra-small semiconductors that integrate a central processing unit (CPU), memory, input/output, and timer on a single chip. They are installed in home appliances, automobiles, industrial equipment, IoT devices, smartphones, and other devices, performing control and computational functions without network connection.

The ‘NuMicro M55M1’ released by Nuvoton is equipped with an ‘Arm Cortex M55 central processing unit (CPU)’ and an ‘Ethos U-55 NPU’, and implements a maximum computing performance of 110GOPS.

KGA and Sejong University Sign MOU for Collaboration on Next-Generation Materials Development

KGA announced on the 25th that it signed a Memorandum of Understanding (MOU) with the Core Research Support Center for Advanced Materials Applications of Metal-Organic Compounds at Sejong University (hereinafter referred to as the Core Research Support Center). Through this agreement, the two organizations plan to conduct joint research and projects based on their respective outstanding technological resources and collaborate closely in the development of next-generation materials and equipment.

The Sejong University Core Research Support Center, which signed an agreement with KAIST, is an institution established to specialize in the study of metal-organic compounds. While metal-organic compounds are already essential materials in advanced semiconductors, their scope of application is expanding recently, particularly for the development of next-generation secondary batteries, including all-solid-state ones.

F&S Tech Develops CMP Pad for Semiconductor Glass Substrates

FNS Tech announced on the 25th that it has developed a CMP pad used when polishing semiconductor glass substrates.

Pads are used to planarize substrates. Specifically, after drilling holes in a glass substrate (after TGV wet etching), they are filled with copper to enable signal transmission. We have developed a CMP pad that can be utilized for planarizing copper on glass substrates.

The company explained that it developed a large-area pad capable of handling large glass surfaces, leveraging technology accumulated in display manufacturing processes such as organic light-emitting diodes (OLEDs). The company added that it had successfully secured the technology and produced prototypes.

DeepX hires a veteran sales executive in the Greater China system semiconductor market.

DeepX announced on the 23rd that it has hired Jack Hwang, Vice President of Indy Semiconductor, who has 23 years of experience in system semiconductor sales.

Vice President Jack Huang is a veteran who has led sales in Asia, including Greater China, for several US fabless semiconductor design companies since 2001. Building on this experience, he will serve as DeepX’s Taiwan/China sales executive.

He joined GEO in 2011 when it was a startup with no revenue and grew it to $50 million (approximately KRW 69.6 billion) in annual revenue. Since its acquisition by Indy in 2023, he has served as Vice President of Sales for the Vision Division’s Asia Pacific (APAC) division.

Nissan and Honda halt production of some electric vehicles sold in the US, reconsidering their strategies.

Japanese broadcaster NHK and other sources reported on the 25th that Nissan Motor Co. and Honda Motor Co. have halted or terminated production of some electric vehicles sold in the United States. Nissan has temporarily suspended production of the Aria electric vehicle, manufactured at its Tochigi Prefecture plant in Honshu, for export to the United States.

While sales of existing inventory will continue, production plans after inventory depletion have reportedly not yet been finalized. Nissan, however, plans to continue producing vehicles for the Japanese domestic market. Honda has also ended production of the ZDX, an electric vehicle from its premium brand Acura, which had previously been outsourced to GM in the United States.

Solus Advanced Materials Receives Approval for High-End Battery Foil from European Battery Manufacturers

Solus Advanced Materials’ high-end battery foil (battery copper foil) has received approval from a global electric vehicle battery company.

Solus Advanced Materials announced on the 26th that it is currently in the process of receiving exclusive approval for its high-strength 6㎛ (micron) “HTS” product from French battery company “ACC.” Solus Advanced Materials is currently the only battery foil company to have received approval for a high-end product from a global battery company based in Europe.

Demand in the European electric vehicle market has been steadily increasing this year, with many automakers and battery manufacturers expanding their presence. Solus Advanced Materials explained that it has passed all approval processes from global companies in the European market.

IL Secures Third Cheonan Plant, Establishes Mass Production System for Key All-Solid-State Battery Materials

IL, a new technology materials specialist, announced on the 25th that it has secured a site near its Cheonan Smart Factory for its third factory, to build a production line for “lithium metal anode sheets” for all-solid-state batteries. The secured site measures 4,423 square meters (approximately 1,340 pyeong), and the company has also completed applications for development permits for a change of use and approval for the new factory construction.

Lithium metal anode sheets are a key material determining the performance of next-generation all-solid-state batteries. Because they can significantly increase energy density compared to conventional graphite anodes, demand is rapidly growing in ultra-high-energy-density applications such as humanoid robots, urban air mobility (UAM), and high-performance electric vehicles.

Phil Energy Partners with Global Companies for Next-Generation Battery Equipment

Phil Energy announced on the 22nd that it had signed an agreement with Elevated Materials on the 19th to jointly develop lithium metal battery equipment. Elevated Materials is a spin-off from Applied Materials, a global semiconductor equipment company based in the U.S.

Elevated Materials has extensive experience in semiconductor and roll-to-roll vacuum deposition. Its primary focus is the production of ultra-thin lithium films, a key battery material. The collaboration between Phil Energy and Elevated Materials focuses on developing mass production facilities that combine next-generation lithium metal and pre-lithiated anode materials with laser technology. The advantage of lithium metal batteries lies in their high energy density. Compared to graphite, which is commonly used as a lithium-ion battery anode material, lithium metal boasts approximately 10 times the capacity.

Top Materials Registers Domestic Patent for “Technology Related to Manufacturing Composite Cathode Active Materials.”

Top Material, a total solution specialist for secondary batteries, announced on the 24th that it has registered a domestic patent for ‘composite cathode active material for lithium secondary batteries, method for manufacturing same, cathode including same, and lithium secondary battery.’

According to the company, this technology is intended to overcome the low rolling density and energy density limitations of existing LFP (LiFePO4) cathode materials.

Currently commercialized LFP cathode materials are of the 2nd to 2.5th generation (compressed density of 2.4 to 2.5 g/cm³), and their low density and output characteristics have been criticized as limitations. In contrast, Chinese companies are leading the market by securing 4th generation (compressed density of 2.6 g/cm³ or higher) technology.

Innometry signs strategic supply agreement with China’s BAK to supply eight units of equipment.

Innometry announced on the 24th that it has signed a strategic supply agreement with Chinese battery manufacturer BAK Power (hereinafter referred to as BAK). This agreement formally establishes the intent and terms of cooperation between the two companies ahead of a large-scale order.

The company explained, “This is a pre-contract signed in anticipation of full-scale orders after building trust through two one-time supply contracts in October of last year and July of this year,” and “We have decided to supply a total of eight non-destructive testing equipment for secondary batteries by next year.”

Volkswagen temporarily suspends operations at its German plant due to weak demand for electric vehicles.

Volkswagen is adjusting production and temporarily suspending operations at two of its German plants as demand for electric vehicles grows more slowly than expected. According to Bloomberg News on the 25th (local time), Volkswagen will suspend production at its Zwickau plant in Saxony for one week, starting on the 6th of next month.

A local factory spokesperson cited sluggish demand for the Audi Q4 e-tron as a backdrop. The model is facing a weakening demand due to the combination of US tariffs and Germany-led discussions to ease the EU ban on internal combustion engine vehicles.

Robots deliver, autonomous car sharing service launches…Toyota’s “Woven City”

Toyota Motor Corporation officially launched its next-generation test city, “Woven City,” on the 25th. Built on a former factory site, the city will operate as a “test course city” to test technologies like autonomous driving, robotics, and next-generation mobility in a real-life environment.

Woven City is located on the former Toyota plant site in Susono, Shizuoka Prefecture, approximately 100km southwest of Tokyo. The newly unveiled Phase 1 area covers approximately 47,000 square meters, or about one-sixth of the total site, and includes 14 buildings, including residential units, retail spaces, and research facilities.

SOS Lab to Equip Next-Generation LiDAR in Fully Autonomous Vehicles

LiDAR specialist SOS Lab announced on the 26th that it is exhibiting a fixed 3D LiDAR mounted on a fully autonomous (Level 4) autonomous vehicle at the ‘2025 World CITYTech Expo’.

The product installed this time is ML-X, which is applied to passenger vehicles. SOS Lab was selected as the domestic lidar supplier for the Ministry of Trade, Industry and Energy’s ‘Designated Area-Based Point-to-Point Mobility LV. 4 Passenger-Class Autonomous Vehicle Platform Technology Development’ project, led by autonomous driving specialist Sonet.

Waymo Launches Enterprise-Only Self-Driving Ride-Hailing Service

Alphabet subsidiary Waymo has launched “Waymo for Business,” a dedicated autonomous ride-hailing service for businesses and organizations. This service is designed to address corporate transportation needs, such as employee commuting and event attendee transportation.

Waymo announced on the 24th (local time) that it is launching a corporate ride-hailing service in San Francisco, Los Angeles, and Phoenix. Unlike the existing paid ride-hailing service offered through the Waymo app, this service provides an interface for businesses, universities, and event organizers to manage discount codes, track usage, and manage budgets. Registration is free, and it can be integrated with corporate transportation support programs.

Amazon subsidiary Zoox takes first steps toward commercializing driverless vehicles.

Zoox, the autonomous vehicle company owned by Amazon, has taken the first step toward commercially operating driverless robotaxis on U.S. roads. The company announced on the 24th (local time) that it recently applied to the National Highway Traffic Safety Administration (NHTSA) for an exemption from some existing vehicle safety standards. If approved, Zoox will be able to deploy up to 2,500 dedicated autonomous vehicles on the road.

This application is considered a step toward commercial operation. The exemptions Zoox requested are based on regulations based on traditional vehicle design, such as wipers, defrostering, and crash safety features. Zoox explained that its vehicles, with their unique design lacking a steering wheel or pedals and a two-way drive system with no front or rear differential, make it difficult to apply existing regulations as is.

Kakao Mobility Strengthens Cooperation with Startups on Autonomous Driving

Kakao Mobility announced on the 22nd that it signed a business agreement with SUM to collaborate on autonomous driving AI-based services. The two companies plan to establish a demand-responsive (DRT) autonomous vehicle service model for residents in transportation-deprived areas.

In particular, we will actively cooperate in linking systems to enable calling, reservations, and payments for DRT autonomous vehicles within the Kakao T platform.

Hanul Materials Science: “JKM Successfully Localizes OLED Film Materials”

Hanul Materials Science announced on the 22nd that its subsidiary JK Materials (JKM) has successfully received its first order and sales of film materials for flexible organic light-emitting diode (OLED) panels.

This material is a key component for improving and managing production yields in the manufacturing of OLED panels for smartphones like Apple’s iPhone. Due to its demanding performance requirements and difficulty in mass production, a single Japanese material supplier has been the sole supplier to global panel manufacturers in Korea and China, resulting in extremely high prices. The material developed and supplied by JKM meets customer performance requirements while offering significantly higher price competitiveness than existing products.

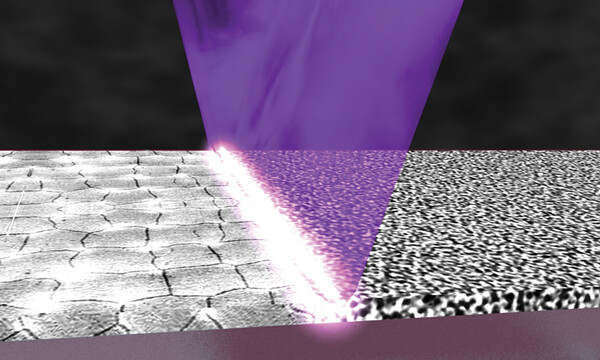

AP Systems to Supply Exclusive Equipment to China’s Visionox OLED Line

AP Systems announced on the 25th that it has signed an exclusive supply contract for ELA (Excimer Laser Annealing) equipment for China’s Visionox’s new 8.6th generation (2290×2620㎜) OLED production line ‘Hefei V5’ project.

It has been decided to participate in a large-scale OLED investment project worth a total of 55 billion yuan (approximately 10.8674 trillion won), but the contract amount was not disclosed.

The ELA equipment supplied by AP Systems is a key equipment that converts amorphous silicon (a-Si) into polysilicon (p-si) in the TFT process, improving the electron transfer speed of LTPS and LTPO OLEDs by more than 100 times, and determines the efficiency and quality of high-resolution OLED panels.

Samsung Display to Start Mass Production of 8.6th-Generation OLED in the Second Quarter of Next Year

Lee Cheong, president of Samsung Display, met with reporters ahead of the ‘Display Day’ ceremony on the 26th and said, “We plan to mass-produce the 8.6th generation around the end of the second quarter or the third quarter of next year,” adding, “It’s going very well so far.”

Samsung Display is investing 4 trillion won to build the world’s first 8.6-generation OLED line at its Asan plant in South Chungcheong Province, and this is the first time it has publicly announced the timing of mass production

Source: Kipost.net

Leave a Reply