General Semiconductor Price Rise… Is This a Sign of a Semiconductor Industry Recovery?

On the 11th, market research firm TrendForce announced that as of the end of last month, the average fixed transaction price of DDR5 16Gb products for PCs was tallied at $3.80, up 1.3% from the previous month. This is the first rebound in six months after a downward trend since August of last year.

DDR5 is the most consumed DRAM model in various fields such as PCs, smartphones, and servers. TrendForce explained, “The price of the older DDR4 is still low, but the price of DDR5 is on the rise,” and “Demand for DDR5 has skyrocketed since the news of DeepSec during the Lunar New Year holiday.”

Bose Semiconductor Signs Agreement with European Automotive OEM to Develop ‘ADAS Chiplet’ Semiconductor

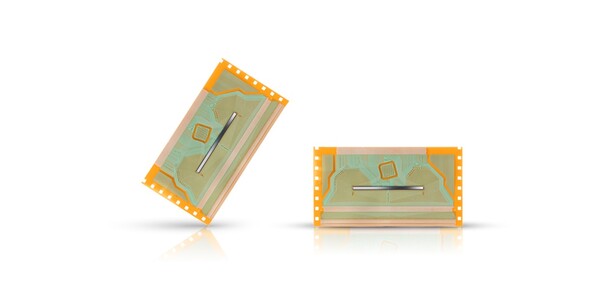

Bose Semiconductor announced on the 12th that it recently signed a contract with a European automobile company to develop ADAS (Advanced Driver Assistance Systems) chiplet semiconductors for next-generation autonomous driving systems.

Through this collaboration, joint development will be carried out across the entire process from the architecture design of the semiconductor to vehicle system verification and ADAS AI software optimization. The goal is to use Bose Semiconductor’s Eagle-N (automotive chiplet AI accelerator) and Eagle-A (standalone ADAS semiconductor) together as a chiplet system to be used in customers’ next-generation vehicle systems.

TSMC Proposes Intel Foundry Joint Venture to Nvidia, AMD, etc.

Reuters reported on the 11th (local time) citing sources that Taiwan’s TSMC has proposed joint investment in Intel’s foundry to Nvidia, AMD, Broadcom, and Qualcomm. If the acquisition becomes a reality, Intel will secure a significant portion of orders from U.S. Big Tech. This could be bad news for Samsung Electronics.

TSMC has reportedly indicated that it will operate Intel’s foundry business but will not own more than a 50% stake. The explanation is that the Trump administration does not want the ownership of Intel Foundry to pass to a foreign company. Reuters added, “If the final deal is concluded, the Trump administration’s approval is absolutely necessary.”

Philoptics, the first semiconductor company to supply ‘singulation’ equipment

Philoptics is supplying ‘singulation’ equipment, one of the core processes in semiconductor glass substrate manufacturing, to global companies. Following the ‘TGV (glass through hole)’ processing equipment that was supplied to the mass production line for the first time in the world last year, it is rapidly expanding its lineup of semiconductor glass substrate equipment.

Philoptics announced on the 13th that it will be shipping laser singulation equipment to overseas semiconductor companies. In accordance with a confidentiality agreement, the transaction counterparty and contract size will not be disclosed.

Laser glass cutting technology is easy to think of as a proven technology as it has been applied in various ways in the display industry. However, semiconductor glass substrates require a much higher level of cutting process technology due to the large differences in product structure and usage environment.

YC Chem, Spin Coating Material for HBM3E… Starts Commercial Production

Semiconductor materials company YC Chem announced on the 11th that it has passed the final mass production evaluation by a global semiconductor company for the next-generation spin coating material (SOC) to be used from HBM3E (5th generation HBM) and has begun commercial production.

A company official said, “We have successfully completed the evaluation of the mass production line of a global semiconductor company for the material, and based on this, we have started mass production of SOC materials optimized for HBM3E and next-generation semiconductor processes.”

Japanese semiconductor hopes in trouble… “Rapidus, Big Tech orders difficult to secure”

Lapidus, a foundry (semiconductor contract manufacturing) company launched to revive the Japanese semiconductor industry, is having difficulty securing customers for the 2nm (㎚; 1㎚ is 1 billionth of a meter) process. Analysis suggests that the lack of experience in advanced processes is holding back its ability to secure orders from global big tech companies.

It is pointed out that in order to be competitive, Rapidus should not only focus on foundry micro-processes, but also secure diverse technologies necessary for advanced semiconductor manufacturing, such as advanced packaging.

DMS enters next-generation semiconductor glass substrate equipment market

DMS announced on the 12th that it has launched its own semiconductor glass substrate wet equipment that combines semiconductor and display equipment technologies and overcomes the limitations of existing panel equipment. Through this, it has secured stable glass substrate handling technology and enables uniformity and particle management for implementing ultra-precision micro-patterns.

Glass substrates have recently emerged as a key material for ‘chiplet’ technology to overcome the limitations of semiconductor miniaturization. Chiplet technology is a method of connecting various types of semiconductor chips on a single substrate like assembling Lego blocks.

It has advantages such as large-area production, cost efficiency, low power consumption, and excellent microcircuit implementation. Due to these characteristics, it is called the ‘dream substrate’, and global semiconductor companies are actively investing in research and development for mass production.

Samyoung to supply secondary battery insulation film to cylindrical battery manufacturer

Samyoung, a company specializing in manufacturing ultra-thin capacitor films, announced on the 12th that it will begin supplying secondary battery insulating films to global cylindrical battery companies.

Samyoung is the only company in Korea that produces capacitor film, a core material for existing capacitors, and is ranked third in the world. As the electric vehicle market expands, the shortage in the capacitor market has led to a significant increase in operating profit for three consecutive years.

In the process of constructing the new line, Samyoung has secured exclusive production technology for the production of more advanced ultra-thin capacitor films. Through the construction of the new line, production volume has increased from the existing monthly average of 600 tons to 1,000 tons, and additional expansion is planned, with the plan to expand production to 1,600 tons per month in the future.

Last year, battery electrolyte usage was 1.07 million tons… China’s share was 85%

According to market research firm SNE Research on the 14th, the total electrolyte loading (consumption) of global pure electric vehicles (EVs), plug-in hybrid vehicles (PHEVs), and hybrid vehicles (HEVs) last year was approximately 1,067,000 tons (t).

This is a 32% increase from the previous year’s 806,000 tons. The electrolyte loading in the market excluding China increased by 15% to 339,000 tons.

Electrolyte is a key material that helps lithium ions move inside a lithium-ion battery. It directly affects the battery charging speed and safety. Last year, the electrolyte market was dominated by Chinese companies. Chinese companies had the highest market share at 84.8%, while Japan had 9.3% and Korea had only 5.9%.

Northvolt finally goes bankrupt… EU battery self-sufficiency ‘red light’

On the 12th (local time), Northvolt announced that the Northvolt AB board of directors had officially filed for bankruptcy in Sweden.

Northvolt explained the background to the bankruptcy, saying, “Recently, rising capital costs, geopolitical instability, resulting supply chain disruptions and changes in market demand have significantly weakened our financial foundation, which is in line with the issues many companies in the battery industry are facing.”

After filing for bankruptcy, an administrator appointed by a Swedish court will oversee the sale of the company’s business and assets and the settlement of outstanding debts.

SK Signet Launches Full Lineup of Electric Vehicle Chargers V2

SK Signet, a global electric vehicle charger manufacturer, unveiled its entire lineup of V2 electric vehicle chargers on the 11th, including medium-speed (30 kW), rapid (50, 100, 200 kW), and ultra-rapid 400 kW. It has been three years since the V2 full lineup was first released in 2022.

Launched in 2021, SK Signet ranked first in market share for the US National Electric Vehicle Charging Infrastructure Subsidy (NEVI) project in North America, the world’s largest market, last year by launching the V1 model.

SKC ‘Rebalancing’, CMP, and Sale of Silicon Anode Subsidiary ‘Ultimus’

SKC is moving forward with the sale of its subsidiary Ultimus, which is in charge of silicon anode materials. Recently, SKC has been improving its profitability by selling off non-core assets such as CMP pads from its subsidiary SK Enpulse and the thin film business from SK Nexilis. This sale of the silicon anode materials business is also analyzed as a rebalancing effort at the SKC level.

According to industry sources, SKC decided to sell Ultimus at a board meeting late last year and classified the related profits and losses as discontinued operating income and losses. Ultimus is currently in the final stages of negotiations with an acquirer.

An SKC official explained, “It is difficult to reveal specific details as the procedures related to the sale of Ultimus are in the final stages,” and “This is a rebalancing at the SKC business level, not a rebalancing at the group level.”

LNF to supply 3.5 trillion won worth of high-nickel cathode materials to global OEMs

LNF announced on the 11th that it had signed a mid- to long-term supply contract for high-nickel cathode materials worth KRW 3.5184 trillion.

According to a confidentiality agreement with the client, the contract partner, sales/supply area, contract period, etc. are all undisclosed. The client is said to be a global original equipment manufacturer (OEM).

High-nickel cathode material is a cathode material manufactured from ternary NCA (nickel, cobalt, manganese). It is mainly used in electric vehicle batteries as a material that can maximize efficiency due to its high energy density and output.

JP Morgan: “Tesla is taking a serious hit… Similar to the 2017 Chinese boycott of Korean cars”

JP Morgan analyzed on the 13th (local time) that Tesla is suffering serious damage due to boycotts and attacks on Tesla, and that this phenomenon is similar to the boycott of Japanese and Korean cars in China in 2012 and 2017.

According to Quartz, an online economic media outlet in the United States, JP Morgan analysts have assessed that Tesla’s corporate reputation has been damaged to an unprecedented degree over the past few months. The Department of Government Efficiency (DOGE), which Musk effectively leads, is leading a large-scale layoff of federal civil servants, and Musk’s far-right tendencies and interference in the internal affairs of other countries are causing resentment to reach a peak.

In 2017, Chinese people boycotted Korean cars in protest of the deployment of the U.S. missile defense system THAAD (Terminal High Altitude Area Defense), and sales of Korean cars have not yet fully recovered.

“Development of Autonomous Vehicle Parts”… Gwanggi Technology Institute and DH Autoware Join Hands

On the 13th, Korea Institute of Photonics and DH Autoware signed a technical cooperation agreement to lead the autonomous vehicle parts market.

This agreement is intended to further strengthen cooperation between the two organizations with the goal of developing core autonomous vehicle components and technological innovation in line with DH Autoware’s relocation to Gwangju.

The Korea Institute of Photonics is a research institute in the optical and related technology fields located in Gwangju. It is conducting a lot of research in the field of advanced sensor technology development such as cameras, lidar, and radar, which are essential for improving the safety of autonomous vehicles, as well as in the field of electrified parts technology including power semiconductors.

Benz to introduce autonomous driving technology from China… “Development of smart car in partnership with Hesai”

German car manufacturer Mercedes-Benz has decided to use LiDAR technology from Chinese company Hesai Technology to develop smart cars targeting the global market, Reuters reported on the 11th.

Citing a person familiar with the matter, Reuters reported that Mercedes-Benz made the decision after months of careful consideration, taking into account geopolitical risks arising from the U.S.-China conflict. The person cited low prices and large-scale production capacity as reasons for Mercedes-Benz’s decision to use Hexi’s lidar in its smart cars.

According to Reuters, this is the first time a foreign automaker has applied Chinese technology to a model that will be sold outside China.

AI motion capture company Moobin attracts 4 billion won in pre-A investment

AI-based 3D motion capture company MOVIN announced on the 12th that it had attracted 4 billion won in investment in a pre-Series A round.

Atium Investment was the lead investor in this investment, and DSC Investment Schmidt participated.

Moobin, comprised of developers from KAIST and Meta Reality Labs, has developed an AI-based motion capture technology that can acquire high-quality 3D motion data in real time without complex equipment and sensors. It is simpler and more economical than existing motion capture systems, while still producing high-quality results.

Eugene Group TXR Robotics Launches Cleaning Robot ‘SLEEK T7’

Eugene Group announced on the 12th that its robot and logistics automation subsidiary TXR Robotics has launched the industrial cleaning robot ‘SLEEK T7’.

This cleaning robot is a product made by Chinese robot company Pudu Robotics. Previously, TXR Robotics signed an exclusive domestic sales contract with Chinese firefighting robot specialist Guixing Zheneng for fire fighting robots and smoke extraction robots.

SLEEK T7 provides an all-in-one cleaning solution that can perform both dry and wet cleaning. In particular, the autonomous driving mode utilizes both the equipped camera and LiDAR technology, a distance measurement technology using lasers, to enable real-time autonomous driving.

Magnachip Semiconductor Decides to Transform into a Pure Power Semiconductor Company

MagnaChip Semiconductor, a mid-sized domestic system semiconductor company, announced on the 13th that it has decided to transform into a pure power semiconductor company. With this, MagnaChip is reviewing all strategic options regarding its display business. Strategic options include sale, merger, establishment of joint venture, licensing, and discontinuation of business.

The display business is expected to be classified as a discontinued business in the company’s first quarter earnings report to be released in May. MagnaChip plans to focus on its power semiconductor business and launch more than 40 new next-generation power semiconductor products this year.

It also plans to invest approximately KRW 100 billion (USD 65 million to 70 million) over the next three years to upgrade its Gumi plant facilities.

Solus Advanced Materials “Starts Supplying OLED Materials (ETL) for TVs”

Solus Advanced Materials announced on the 13th that it has received customer approval for its next-generation electron transport layer (ETL) product for domestic large TVs and has begun mass production and supply.

ETL is one of the auxiliary layers of an organic light-emitting diode (OLED) display, and it plays a role in transferring electrons to the light-emitting layer. The ETL market for large-screen TVs was previously monopolized by Germany’s Novaled.

The company explained that it has entered the next-generation model in recognition of its improved operating voltage and lifespan.

OLED for smartphones surpasses LCD for the first time last year

According to market research firm Omdia, OLEDs accounted for 51% of smartphone displays shipped last year, surpassing liquid crystal displays (LCDs) for the first time.

OLED shipments were tallied at 784 million units, up 26% from 2023. On the other hand, LCD shipments decreased by 8% during the same period, reaching 761 million units.

The reversal of LCD is interpreted as the result of OLED being adopted even in popular smartphones. Samsung Electronics adopted OLED even in the A1 series, which is a lower lineup of the Galaxy A, and Chinese smartphone manufacturers have also expanded the application of OLED in large numbers.

However, Chinese smartphone manufacturers have been focusing on increasing the adoption of domestic OLEDs, and Chinese OLED shipments have increased by 45% compared to 2023. As a result, the market share of Chinese OLEDs has approached 45%.

Source: kipost.net